While you’re getting ready for the end of year make sure you also send all the clients you worked with this year and that paid you more than $600 a W-9 Form.

Why? because businesses that hire independent consultants, anyone that is not incorporated (except attorneys) need to submit 1099s on behalf of their businesses by January 31.

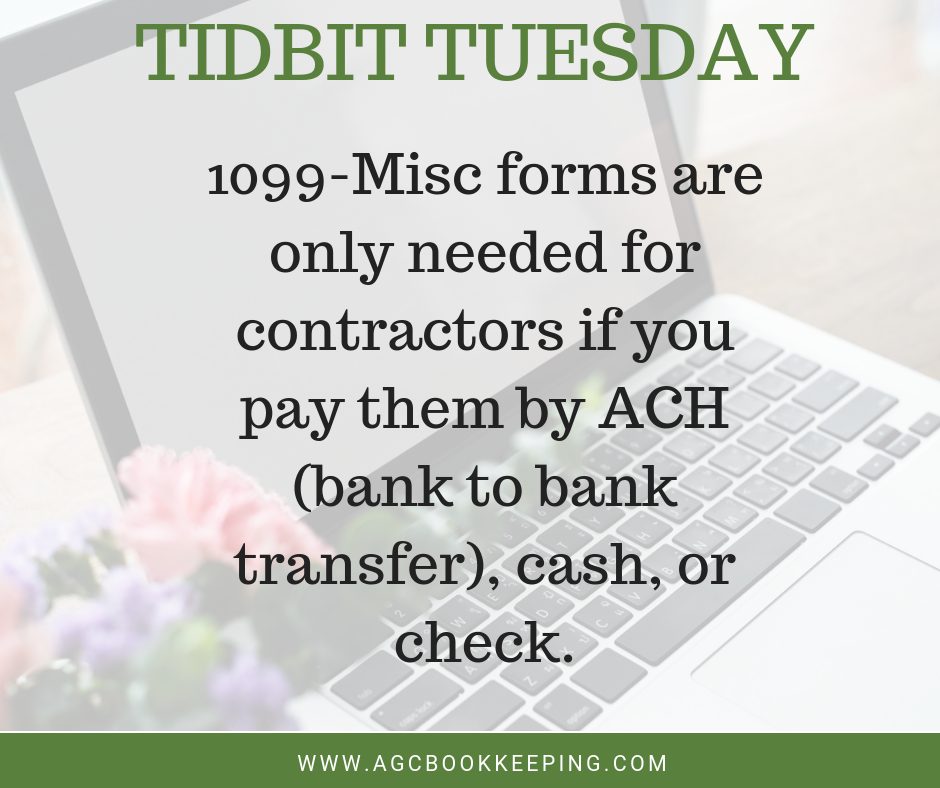

Also, on the flip side. If YOU paid any independent consultants to do work on behalf of your business more than $600 then you need to request a W9 from them and then you need to send them a 1099-Misc form.

Confused? don’t worry we can help you with both.